When money problems happen quickly, payday loans from a legal money lender in Singapore are often a quick way to meet instant needs. What’s going on beneath the surface of this short-term comfort, though? This article talks about the tricky situation of payday loans and how to balance meeting immediate wants with protecting your long-term financial health.

Payday loans: What You Need to Know

First, let’s talk about what payday loans are. Then we can talk about how hard the payday loan problem is. People who need cash quickly and need to pay for something right away can get these short-term loans. It’s easy to get to them, there aren’t many requirements to meet, and the acceptance process is quick. But the fact that they are easy to use comes at a cost, generally in the form of high fees and interest rates.

Needs Right Now vs. Long-Term Financial Health

Picture this: your car breaks down out of the blue, leaving you without a way to get home. Or maybe an unexpected medical bill shows up in the mail and needs to be paid right away. When things like this happen, payday loans can save your life because they let you meet important needs right away. Short-term gains may not be as clear when you need cash quickly. When you borrow money with high interest rates, you might borrow more, which is bad for your long-term earnings.

#1: Risks and Effects

Payday loans aren’t just bad for getting money quickly; they cause other issues as well. People who take out these loans can get stuck in a cycle of borrowing and paying back loans that makes their finances unstable because the interest rates are so high. Also, payday loans can hurt your credit score, which can make it harder to borrow money in the future and hurt your general financial health.

Ways to Borrow Money in a Smart Way

Even though payday loans can be tempting because they offer quick cash, it’s important to be careful and smart about them. Before you take out a high-interest loan, think about how quickly you need the money. Are there other places I can get short-term financing? Could you look into budgets and planning ways to deal with costs without taking out loans? If you want to borrow money responsibly, you should weigh your current need for cash against how it will affect your long-term finances.

Building financial strength

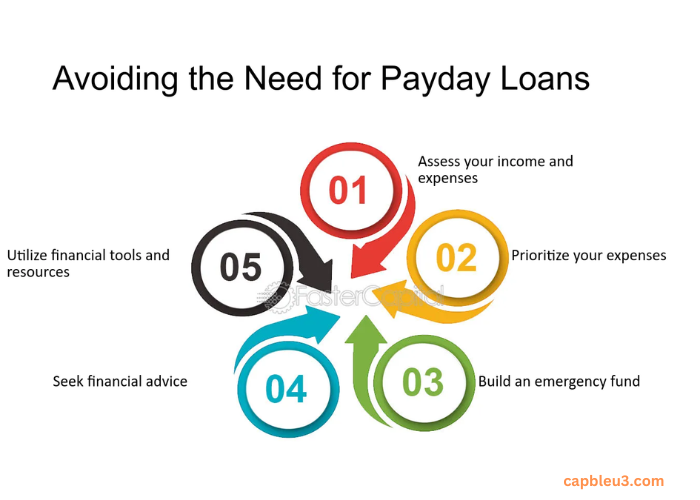

Payday loans from a Jurong East money lender can help in the short term, but they’re not a long-term answer to money problems.It’s important to have a big emergency savings fund ready in case you need to pay for something unexpected.One way to do that is to make a long-term plan for your money that fits your goals and dreams. Get help and learn about money. This will give you useful knowledge and tools to fix your money problems.

In conclusion

The issue of payday loans is a big one in the complicated world of money choices. It takes careful planning and thought to find the right mix between short-term wants and long-term financial health. While payday loans might help in the short term, they come with risks and consequences that last a lot longer than the short-term stress. People who have money problems can feel strong and confident if they know how to take money wisely, get tough with money, and ask for help when they need it. This will keep their money safe in the long run.